Safe Harbour Rules - Indian Transfer Pricing Regulations

Home > Safe Harbour Rules – Indian Transfer Pricing Regulations

September 20, 2024

India’s Transfer Pricing Safe Harbour Regime: An Overview

Overview of the Indian Safe Harbour Regime

- The Indian Safe Harbour Regime was established in response to escalating instances of transfer pricing audits and disputes. Introduced under the Finance (No.2) Act of 2009, effective from April 1, 2009, this regime was introduced vide Section 92CB of the Income Tax Act, 1961.

- Under section 92CB, the determination of an arm’s length price, as defined by section 92C or Section 92CA, is required to adhere to safe harbour rules. These rules provide predefined acceptable ranges of profits or prices, enhancing certainty for transactions.

- To provide greater advantages to taxpayers, the Central Board of Direct Taxes (CBDT) broadened the scope of Safe Harbour Rules through Rule 10TD of the Income-tax Rules. This expansion aims to streamline compliance procedures, encourage timely approvals, and reduce complexities associated with transfer pricing.

- The Indian Safe Harbour Regime offers a structured and predictable framework that promotes compliance, minimizes disputes, and fosters a more harmonious business environment, ultimately contributing to a

more efficient and effective transfer pricing ecosystem.

Eligible Assessee

A person who has validly opted for safe harbour rules under Rule 10TE of the Income Tax Rules, 1962.

Eligible Transactions

These eligible transactions qualify for safe harbour treatment under Rule 10TB, providing a simplified and predictable transfer pricing framework.

The Rational Choice: Selecting the Safe Harbour Option

Advantages of Choosing the Safe Harbour Approach

Enhanced Certainty

By providing advance insight into the acceptable range of profits or prices that meet Safe Harbour criteria, transactions gain a heightened level of certainty, offering stakeholders a clearer financial landscape.

Conflict Mitigation

Safe Harbour serves as an effective dispute avoidance mechanism, significantly curbing the potential for conflicts between taxpayers and revenue authorities. This fosters a more harmonious business environment, particularly significant given the high incidence of Indian Transfer Pricing litigation.

Streamlined Approvals & Assessment

Safe Harbour Rules offer a structured mechanism for application and approvals procedures, facilitating a smoother and time-bound process. This stands in stark contrast to the prolonged timelines associated with Domestic Litigation or Advance Pricing Agreements (APAs).

Comparative Compliance

In contrast to the complexities involved in Advance Pricing Agreements (APAs) and the Domestic Transfer Pricing Litigation Route, Safe Harbour Rules present a more favorable choice in terms of TP/ALP rates/margins, timelines, and associated costs. This streamlined approach can alleviate compliance burdens.

Resource Efficiency

The adoption of Safe Harbour Rules translates into substantial savings in terms of time, costs, and efforts, especially in potential litigation scenarios. This strategic choice can lead to optimized resource allocation and more efficient business operations.

Stakeholder Confidence

Safe Harbour instills confidence in taxpayers through its predictable framework, enhancing investor confidence and fostering robust business growth.

Safeguarding Reputational Capital

Choosing the Safe Harbour route mitigates the risk of reputational damage that could arise from contentious transfer pricing disputes. A clean record in compliance can enhance a company’s standing within its Group and among stakeholders.

Incentive for Voluntary Compliance

The transparent and predictable nature of Safe Harbour can incentivize voluntary compliance, enabling companies to proactively meet their transfer pricing obligations and contribute positively to the overall tax ecosystem.

Core Features of the Safe Harbour Rules in India

Safe Harbour Rules in India: Key Points for Taxpayers

For those seeking to opt for safe harbour rules and who have undertaken in eligible international transactions, adherence to specific guidelines is imperative. Here’s a concise breakdown of the crucial aspects:

Filing Requirement

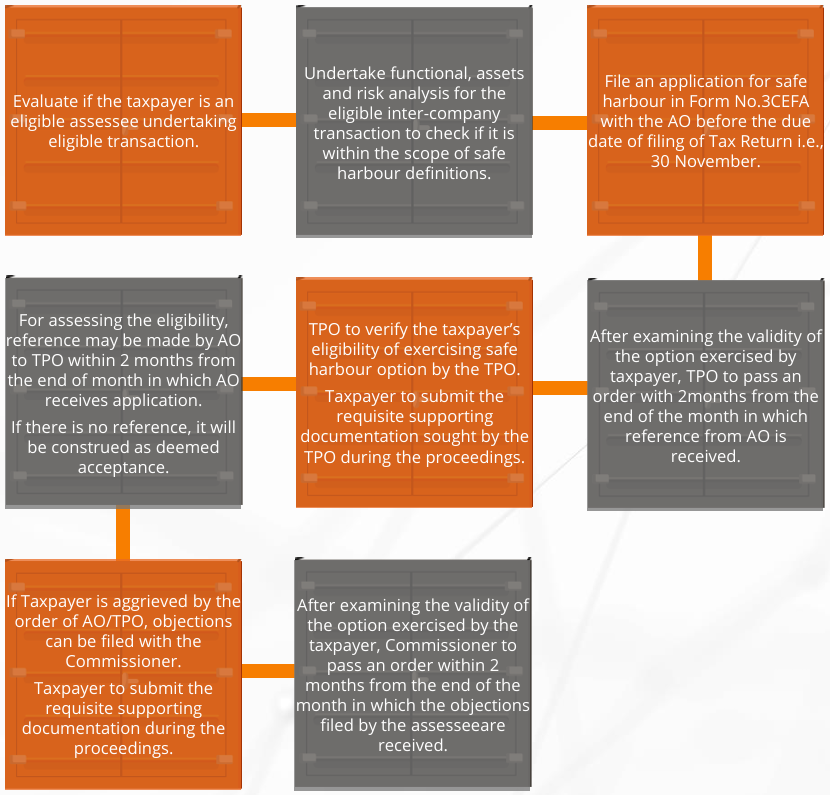

Taxpayers opting for safe harbour need to file an income return and safe harbour application (Form No 3CEFA) to the Assessing Officer, both before the stipulated deadline i.e., 30 November following the relevant FY.

Compliance Commitment

Even if opting for safe harbour, taxpayers must fulfill the prescribed transfer pricing documentation and maintain/Form 3CEB filing compliances (Rule 10TD(5) of the Rules).

Geographical Limitations

Safe harbour doesn’t apply to transactions with Associated Enterprises/Related Parties location in low or no tax countries.

Mutual Agreement Procedure (MAP)

If approved, the transfer price by the tax authorities for an eligible international transaction bars the assessee from invoking the Mutual Agreement Procedure in a double taxation avoidance agreement with a foreign entity.

Adjustment Constraints

When opting for safe harbour, comparability adjustments and prescribed variation/range benefits (tolerance band) aren’t accessible (Rule 10TD(4) of the Rules).

Duration of Choice

The option exercised remains in effect for a period as notified by the CBDT.

Transaction Scope

Safe harbour applies solely to specified transactions, while TP scrutiny exposure remains open to other transactions not eligible under safe harbour.

Deemed Acceptance

If the Assessing Officer, Transfer Pricing Officer, or the Commissioner, as the case may be, does not make a reference or pass an order within the specified time, then the option for safe harbor exercised by the assessee shall be treated as valid.

Scope of definitions

The scope of Operating Revenue and Operating Expense to be used in the computation of the Operating Margin has been clearly defined in the Safe Harbour Rules.

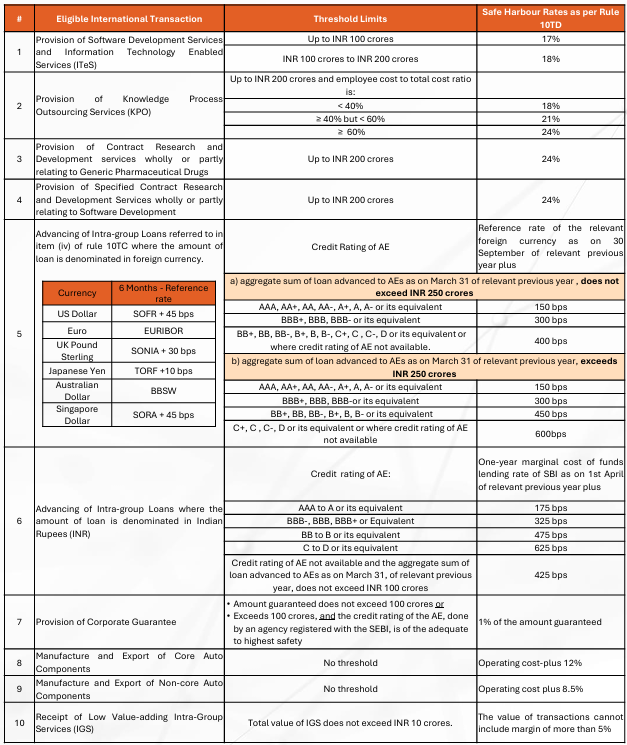

Indian Safe Harbour Rules – Latest Safe Harbour

Margins

Safe Harbour Procedure

How can SBC assist you?

Navigating the Safe Harbour Application process doesn’t have to be overwhelming. We’re here to provide discreet and effective assistance every step of the way.

SBC support:

- We provide assistance in filing Form No. 3CEFA (Safe Harbour Application), ensuring a smooth process.

- Our experts evaluate your eligibility for Safe Harbour Rules (SHR) by undertaking functional analysis and review of inter-company transactions and underlying agreements to guide your decision-making.

- We conduct a comprehensive cost-benefit analysis to help you assess your options effectively.

- If needed, we calculate year-end transfer pricing adjustments to align with safe harbour rates.

- Our support extends to year-end compliance, including Form No. 3CEB and transfer pricing documentation.

- We offer representation support before tax authorities (AO & TPO) for safe harbour proceedings.

Verify Email

Verify your email address below to download the PDF