GST Amnesty Scheme U/S 128A

- Home

- GST Amnesty Scheme U/S 128A

August 12, 2024

The Financial Bill released on July 23, 2024, introduces a significant new provision Section 128A to the Central Goods and Services Tax (CGST) Act. This section specifically addresses the waiver of interest or penalties, or both, related to demands raised under Section 73 of the CGST Act for certain tax periods. This change aligns with discussions from the 53rd GST Council meeting held onJune 22, 2024, which highlighted the need for a more flexible approach to tax compliance and

enforcement. Section 128A aims to offer relief to businesses by reducing the financial burden of interest and penalties, thus fostering a more supportive tax environment.

June 24 2024

GST Council Meeting

June 23 2024

Financial Bill

March 31 2024

Deadline forTax Payment as per 53rd GST Council Meeting

Note: ThePressReleaseissuedafter the 53rdGSTCouncil Meeting initially specified a cut-off date of March 31, 2025. However, lawmakers have granted the Government the authority to extend this deadline if necessary. Therefore, the Government may notify an extended deadline as deemed appropriate, though it is yet to be formally notified

What is an Amnesty Scheme ?

- An amnesty scheme in taxation refers to a limited-time opportunity offered by the government to taxpayers to settle their outstanding tax liabilities with reduced penalties and interest.

- Theseschemesaredesignedto encourage voluntary compliance, clearbacklogs of disputed tax demands, and increase tax revenue by providing a more lenient settlement option comparedtostandard enforcement measures.

- Benefits in an Amnesty Scheme include:

• Significant reduction or waiver of penalties

• Encourages regular tax compliance.

• Resolveslong-standing disputes.

• Restores blocked ITC for better cash flow

• Helps avoid legal proceedings

Is this the first ever Amnesty Scheme?

Previously (as examples shown below) are amnesty schemes under the CBIC which have typically addressed issues related to the late submission of GST monthly and Annual Returns. These initiatives aimed to alleviate penalties and encourage compliance among taxpayers. Similarly, The latest scheme, discussed in the 53rd GST Council meeting and

detailed in the financial bill, 2024, introduces Section 128A in CGST Act to provide conditional waiver of interest or penalty or both relating to demands raised under section 73 years 2017-18, 2018-19 and 2019-20 , in cases where demand notices have been issued under section 73and full taxliability is paid by the taxpayer before a date to be notified.

What is Covered in the Proposed Scheme?

Scope: Applies specifically to demands under Section 73, which generally deals with non-fraudulent tax discrepancies and refunds.

Time Frame: Relief applicable for tax periods from FY2017-18 to FY2019-20.

Due Date for Payment: All taxes must be paid on or before March 31, 2025 as per the 53rd GST Council meeting. However, currently the law remains silent and an official notification from the government is yet to be issued.

Relief: Complete waiver of interest and penalty.

What is Not Covered in the Scheme?

While the proposed GST Amnesty Scheme under Section 128A offers significant relief to taxpayers, it is important to understand that certain cases are noteligible for this scheme. This exclusion aims to maintain the integrity of the tax system and ensure that the scheme benefits those who comply with the law in good faith. The following are the key

exclusions:

- Demands raised under Section 74, i.e., cases involving fraud, willful misstatement, or suppression of facts to evade tax.

- Erroneous refunds received by the assesses.

- No refund will be issued for interest and penalty already paid by the taxpayers.

Advantages of the Scheme

- Reduction in Litigation: By offering a waiver of interest and penalties, the scheme incentivizes taxpayers to settle disputes without further legal proceedings, reducing the burden on tax tribunals and courts.

- Revenue Generation: The scheme encourages the payment of outstanding taxes, leading to immediate revenue generation for the government.

- Relief for Taxpayers: Provides significant relief to taxpayers who faced difficulties during the initial years of GST implementation, offering a chance to settle their dues with a reduced financial burden.

Is Excluding erroneous refunds justified?

- Unlike income tax refunds, delayed GST refunds do not receive the benefit of delayed interest. Many taxpayers have approached High Courts seeking interest on delayed refunds and have GST authorities.

- Erroneous refunds typically involve the utilization of Input Tax Credit (ITC), which should not attract interest unless it pertains to ineligible credits. Denying amnesty benefits solely because the credit was utilized through are fund is unjustified.

- Penalties for erroneous refunds, especially those obtained through specific applications like RFD-01 and verified by an officer, are not warranted. Extending penalty waivers to erroneous refunds would help resolve disputes and litigation

Is the Scheme Applicable at all stages of Litigation?

The applicability extends to:

- Notice issued under section 73 of the CGST Act: The scheme covers cases where a notice has been issued under Section 73 for recovery of tax not paid or short paid or erroneously refunded, or input tax credit wrongly availed or utilized.

- Notice issued under section 74, deemed as issued under section 73 due to the absence of elements of fraud/suppression/ wilful misstatement: If a notice initially issued under Section 74 is later deemed to be issued under Section 73 because it lacks elements of fraud, suppression, or wilful misstatement, it falls under the purview of this amnesty scheme.

- Order issued under section 73 of the CGST Act, where no order under sub-section (11) of section 107 [Appellate Authority] or sub-section (1) of section 108 [Revisional Authority] has been issued: If an order has been issued under Section 73, and there is no subsequent order from the Appellate Authority (Section 107) or the Revisional Authority (Section 108), this situation is also covered by the amnesty scheme.

- Orders issued under section 73(9) and further no orders have been passed from high court/ supreme court under sections 117 or 118 respectively: The scheme is still applicable, subjective to withdrawal of appeal before high court/supremecourt.

- Appeal Order or Revisional Authority Order: The scheme also includes cases where orders have been issued by the Appellate Authority or the Revisional Authority.

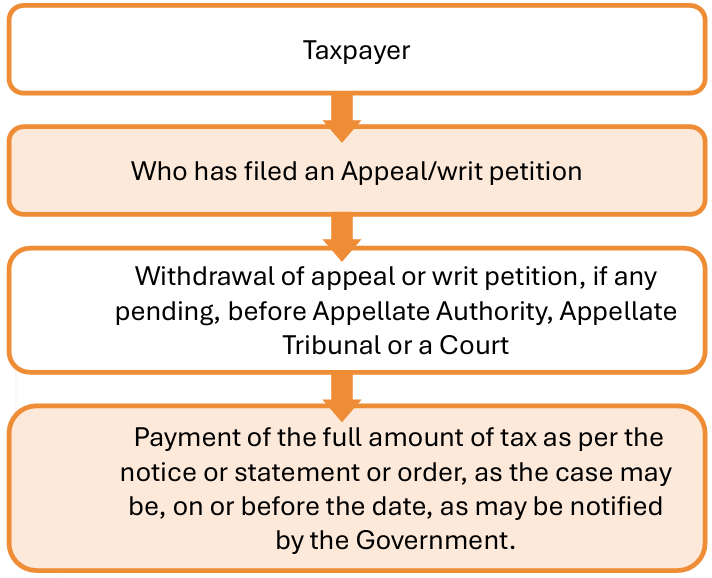

If the Litigation is initiated by a Taxpayer

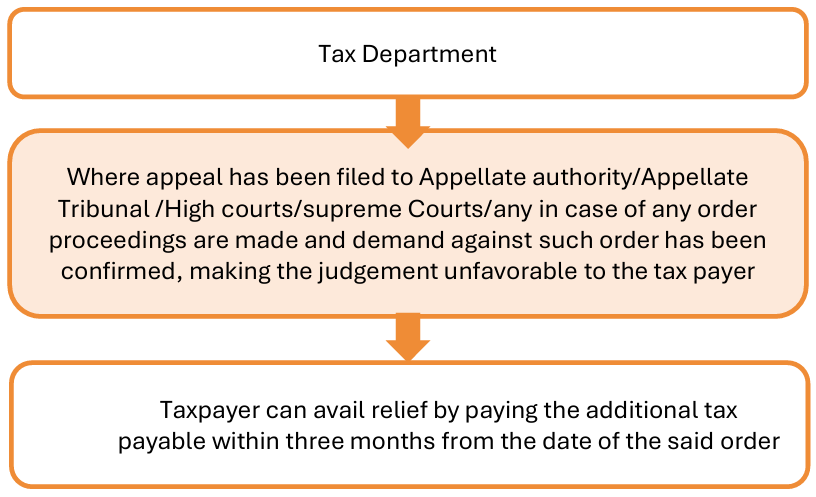

If the Litigation is initiated by the department

Suggestions for Different Cases

- ASMT-10(It is often used to issue an assessment order, which might result in a demand for tax liability. Once the assessment is complete and if any tax dues are identified, the GST officer may issue DRC-01 to formally demand the payment of the assessed tax amount.)

- DRC-01 (i. It is a formal show cause notice to the taxpayer indicating the amount of tax, interest, and penalty issued after the taxpayer does not respond satisfactorily to the DRC-01A or does not comply with the intimation provided therein.

ii. Issued right afterward if there is a need to formally demand the payment of the tax assessed in ASMT

10.)

- DRC–07 (issued after the adjudication of the show cause notice (DRC-01) when the tax authority has made a final determination.)

- GSTAPL– 01 (An Appeal to Appellate Authority by a taxpayer or an unregistered person aggrieved by any decision or order passed against him by an adjudicating authority.)

- Or when a writ petition is filed.

For all the above cases , there can be three possible outcomes:

A. Acceptance of all allegations – Pay the demanded tax amount and avail benefits of section 128A i.e– waiver of interest and penalty.

B. Acceptance of some of the allegations – Pay tax, interest and penalties attracted towards accepted allegations.

C. Declination of all the allegations – Go for further proceedings or pay the pre-deposit for further appeals.

Is Excluding cases related to Section 74 of the CGST Act Justifiable?

- The government’s decision not to extend this scheme to Section 74 cases is understandable, given the association of fraudulent intentions with taxpayers falling under this section.

- However, numerous notices are issued under Section 74 without sufficient grounds, often after the expiration of the time limit for issuing show cause notices under Section 73.

- In such cases, taxpayers who wish to settle disputes based on their merits face the imposition of interest and penalties.

- Extending the benefits of the scheme to these cases could potentially resolve a significant number of disputes.

- Moreover, when Section 74 notices are issued within the timeframe set for Section 73 notices, Section 75(2) considers these notices as being issued under Section 73.

- However, delays in making these decisions beyond March 31, 2025, would mean that taxpayers miss out on the opportunity to benefit from the amnesty scheme.

Can we avail the scheme benefit for specific issues of a single notice?

- No, the scheme doesn’t benefit only specific issues of a single notice.

- Upon reviewing past Amnesty Schemes under income and Service Tax, it becomes evident that the government’s primary aim in introducing these schemes is to effectively reduce and resolve cases in their entirety, rather than offering partial relief.

- We are pretty much sure that the proposed scheme will continue to do the same, by providing comprehensive solutions without partial measures.

- Taxpayers facing notices that include both favourable and unfavourable judgements must carefully assess their options under the scheme to ensure they maximize the benefits available to them.

Are Transition Credit Disputes Covered

Under this scheme?

- The new amnesty scheme under Section 128A of the CGST Act covers certain transitional credit disputes.

- If there is an ongoing dispute under Section 73 that involves the credit or tax payments related to the previous regime, it should be resolved before claiming transitional credit. This is to ensure that any claims made are accurate and not affected by unresolved issues.

- Transitional credits refer to the input tax credits that taxpayers were entitled to carry forward from the pre-GST regime to the GST regime under Section 140 of the CGST Act.

- The Supreme Court, in the case of Filco Trade Centre Pvt. Ltd. vs Union of India, directed the Goods and Services Tax Network (GSTN) to provide a one-time opportunity for all taxpayers to either file or revise Form TRAN-1. This decision allows taxpayers to claim transitional credits that were initially not claimed.

- Many taxpayers faced technical issues or other difficulties in filing or correctly submitting Form TRAN-1 within the stipulated deadline.

- Hence, the Supreme Court ordered GSTN to open a one-time window for all taxpayers to either file Form TRAN-1 or revise the previously filed Form TRAN-1 to claim unclaimed transitional credits.

- Now, for cases were transitional credit claimed post 1st July 2017, we are at a view that the remedy available u/s 128A can be availed.

SBC Takeaways

- The introduction of Section 128A in the Finance (No.2) Bill –2024 is a strategic move to ease the burden on taxpayers involved in non-fraud cases under Section 73 of the CGST Act.

- This amendment provides relief through conditional waivers while ensuring that tax collection goals are achieved.

- The exclusion of erroneous refunds from the waiver scope also serves to prevent revenue losses.

- Participating in the amnesty scheme can help businesses ensure that their transitional credit claims are accurate and compliant with GST regulations, thus avoiding disputes or penalties.

- For notices which state multiple issues, the benefit of waiver cannot be claimed for a certain or specific issue.

- Overall, this amendment benefits taxpayers by creating a supportive and compliant tax environment, while simultaneously maintaining the revenue authority’s focus on genuine tax collection efforts.

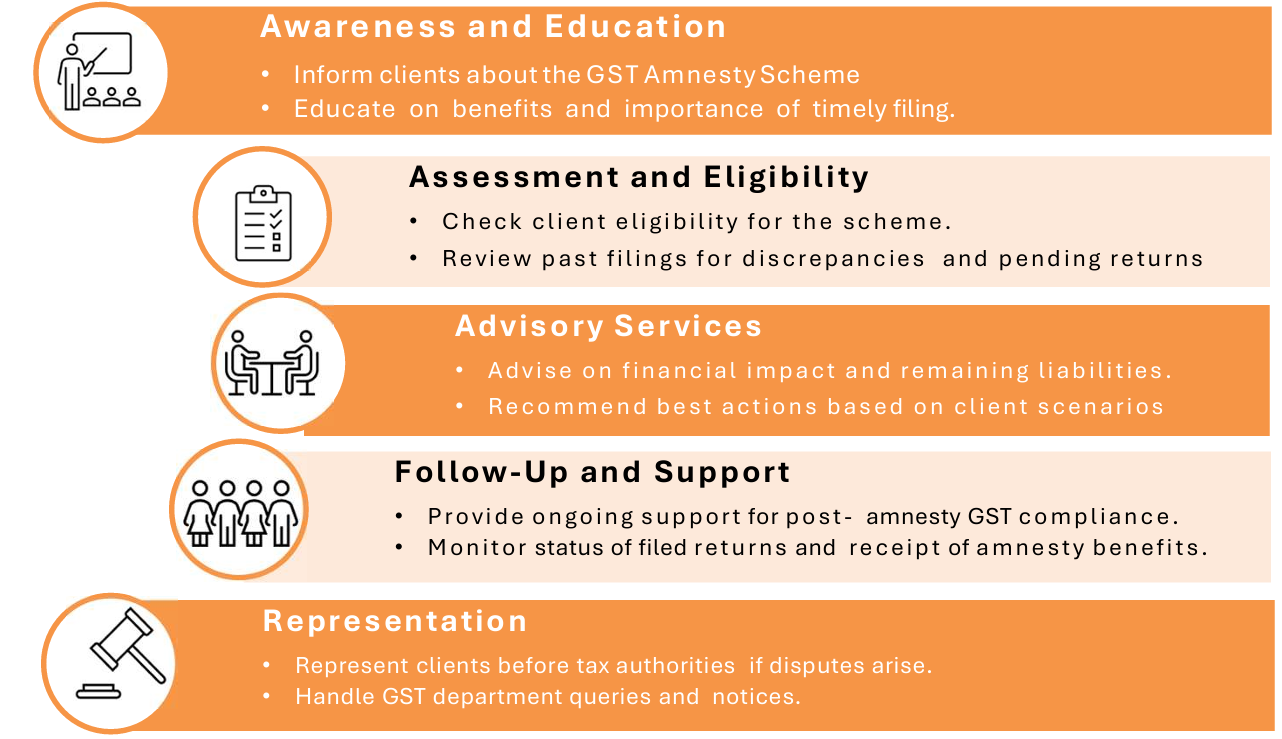

How Can SBC help in Amnesty Scheme?

Verify Email

Verify your email address below to download the PDF