TAX IMPLICATIONS ON E-COMMERCE OPERATORS

September 21, 2022

Online services are becoming more and more well-liked and in high demand, proving that digitalization is the future. The rise of e-commerce companies is one of the most obvious shifts in the digital economy. In this article, we go through the direct tax ramifications for e-commerce operators who may or may not be residents.

Background

E-commerce transactions are impacted by several tax laws, including those relating to income tax and GST in India. To avoid taxing transactions and gain tax benefits, the government is adopting several sections in both direct and indirect tax regimes. Small sellers who sold their goods or rendered services through E-Commerce Operators were formerly exempt from taxation and could avoid paying taxes on those transactions since there were no regulations governing them. Additionally, non-resident online merchants gained money in India without paying taxes. As a result, the Government added the following provisions to the GST and Income Tax.

Under the Income-tax laws, the tax and withholding tax implications vary depending upon the role observed by an entity in the chain of e-commerce transactions.

Key Terms

E-commerce consists of the following things that one must be aware of:

i. Ecommerce Operator: A person who owns, controls, or runs a digital or electronic facility or platform for electronic commerce is referred to as an “e-commerce operator” or an ECO. An ECO in India may or may not be a resident.

ii. Ecommerce Participant: An “e-commerce participant” or ECP is a resident of India who uses a digital or electronic facility or platform for electronic commerce to sell goods, render services, or both, including digital commodities.

iii. E-commerce Supply or services”:

(a) Online sale of goods owned by the ECO; or

(b) Online provision of services provided by the ECO; or

(c) Online sale of goods or provision of services or both, facilitated by the ECOr; or

(d) Any combination of activities listed in clause (i), (ii) or clause (iii).

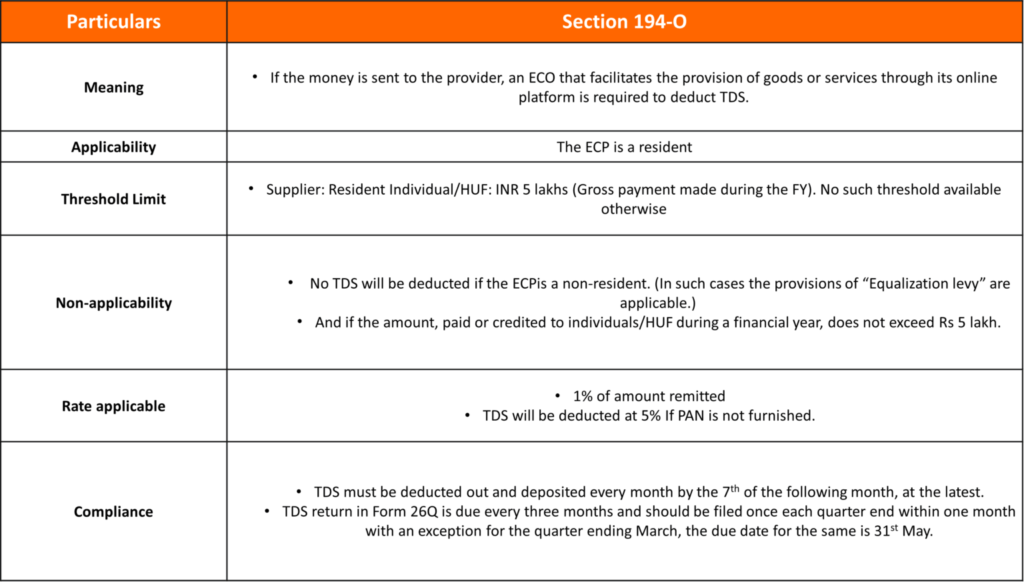

Tax (TDS) to be deducted by E-Commerce Operator on payments made to E-Commerce Participant

In accordance with the Explanation to Section 194O, any payment made directly to an ECP by a buyer of goods or a recipient of services for the sale of goods or the provision of services, or both, that was made possible by an ECO shall be considered to be the amount credited or paid by the ECO to the ECP and must also be included with the gross amount of these kinds of sale or services for the purpose of TDS.

Note, no TDS would be applicable if the ECP is a non-resident.

What are the Applicable Income Tax Provisions for An E-Commerce Operator?

Let’s look at the different income tax regulations that you, as an operator of an ecommerce marketplace, need to be aware of:

For Resident ECO:

An ECO is deemed to be a resident ECO if it is registered in India, has a permanent establishment there, or satisfies the requirements of Section 6 (the residency test) of Indian Income tax laws. According to income tax regulations, the following compliances must be made by Residents ECO:

1. Income Tax Return

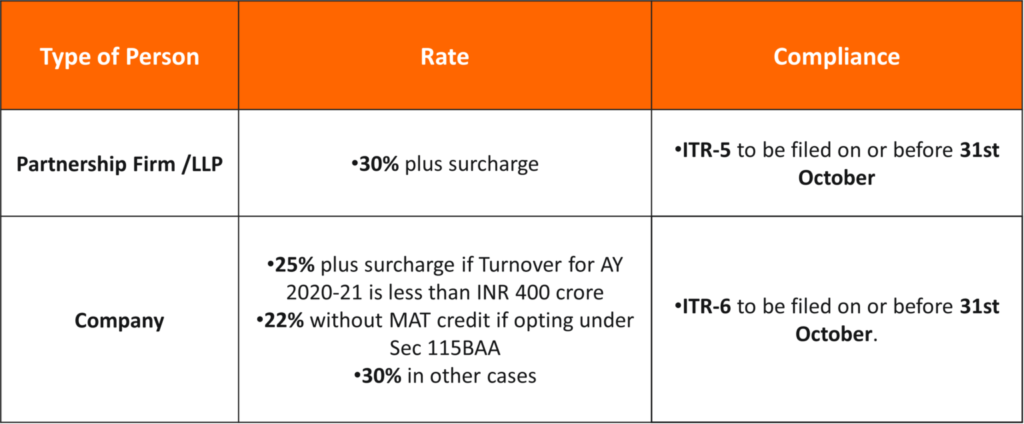

Commission—main ECO’s source of income—is classified under the head “Profits and Gains from Business and Profession.” The following table summarises resident ECO compliance.

NOTE: A tax audit is legally required to be conducted if the ECO’s annual revenue exceeds INR 10 crore and more than 95 percent of its transactions are made in an “other than cash” mode. If the “other than cash” requirement is not met, the INR 1 crore threshold for applicability of a tax audit is used instead.

TDS to be deducted under Section 194-O

For Non-Resident E-Com Operators

An ECO is said to be non-resident if it is not registered in India and does not create a residence as per Section 6 requirements.

A non-resident ECO would be subject to following compliances and levy:

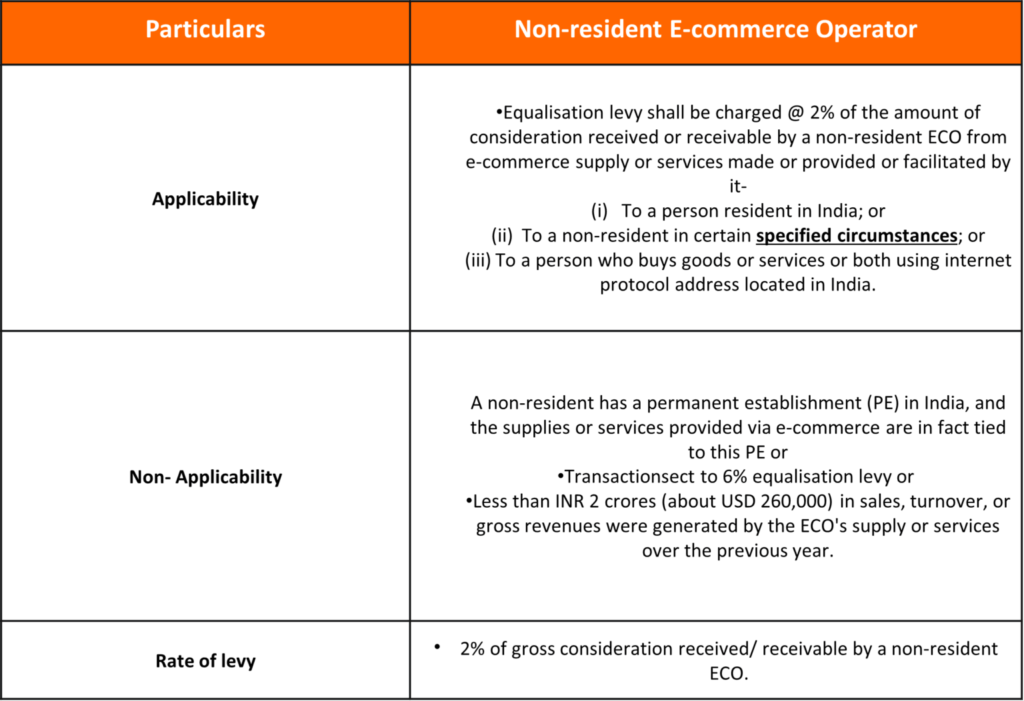

1. Equalisation Levy under Sec 165A:

Yes, regardless of whether you have a large or small business, the office of the CFO is extremely important to any business. Since costing is always a concern for a business, it is wise to hire a virtual CFO.

Who is liable to pay Equalisation Levy under section 165A

The equalisation levy under section 165A (read with section 166A) shall be paid by the non-resident ECO providing e-commerce supply or services.

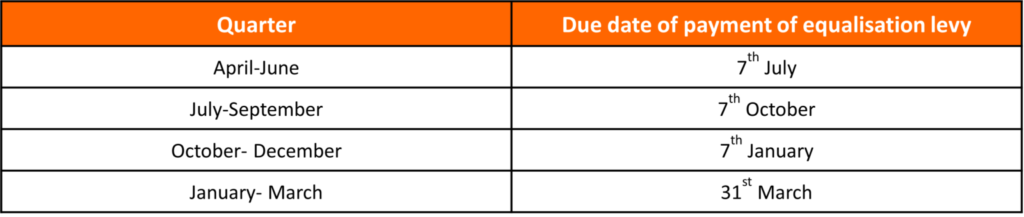

What is the due date of depositing Equalisation Levy under section 166A

Equalisation Levy according to section 166A is required to be deposited by the e-commerce operator on quarterly basis on challan no. ITNS 285 as follows:

What are the returns to be furnished for reporting equalisation levy by an ECO

- Every ECO liable to pay equalisation levy shall furnish an annual statement containing all particulars, as prescribed in Form No. 1 on or before 30th June immediately following that financial year.

- The Form should be signed and verified electronically under digital signature or electronic verification code.

Equalization Levy Vs TDS under Section 194O

An Interplay

The main consideration under Equalisation levy is upon the buyer on the NR E Commerce platform whereas for TDS under Section194-O it is upon the residency of the ECP.

Following is an instance where both the provisions are applicable .

A Buyer resident in India purchases goods on an E Commerce platform run by a NR from a seller (ECP) who is a resident in India. In such a scenario, NR ECO would be liable to pay an equalisation levy @ 2% in India (subject to other conditions of the section being satisfied) and deduct tax @1% u/s 194 O of the ITA from the payment to be made to the seller.

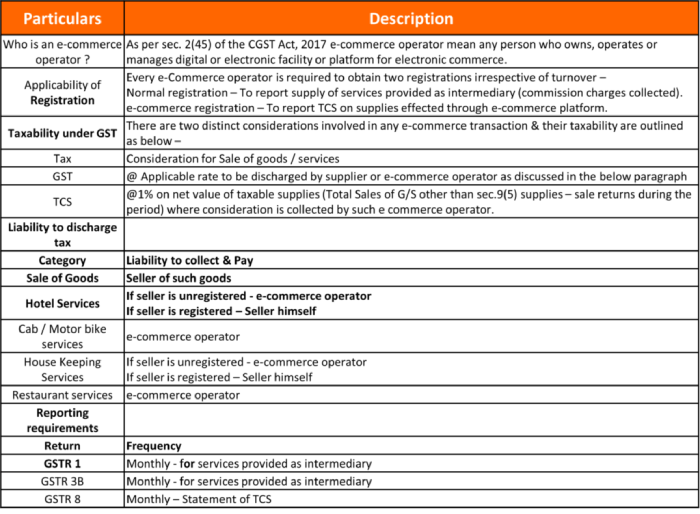

Under GST Act

The GST implications for an e-commerce operator are broadly outlined below –

At Steadfast Business Consulting, we take care of all the Income Tax Laws and GST practices so that you can carry out your business operation in a hassle-free manner without worrying about the compliances your business needs to follow. Get in touch with our experts to know more about our tax services.

CONTACT US

RELATED POSTS

RELATED POSTS

- An Overview: Corporate Taxation In India

- Why Hire SBC For GST Services?

- How Tax Consulting Services Are Helpful To Your Business?

- Why Are Mergers & Acquisitions Service Crucial For Enterprises

- Transfer Pricing Services And Consultancy: Top Reasons Why You Should Choose SBC

- Why Your Business Should Get A Corporate Valuation?

- Take Charge Of Your Taxes In Legal, & Ethical Ways With Steadfast Tax Planning Services